2025 Open Enrollment Resources

Open Enrollment is from November 4th – 18th

For questions, please contact HelloFresh Benefits

and Payroll Connect at 877-431-7867

Open Enrollment Resources

2025 Open Enrollment Guide – English

2025 Open Enrollment Guide – Spanish – Coming Soon

Enrollment Instructions and Assistance

Enrollment Instructions – Desktop & Android & Apple

Benefits and Payroll Connect Service Center

For questions, please contact HelloFresh

Benefits and Payroll Connect at 877-431-7867

Cigna – Medical

Plan Information

Coverage Period: January 1, 2025 to December 31, 2025

Group Number: 3345209

Member Services: 877.501.7990

Member Website: https://www.CIGNA.com

Cigna – Medical

Additional Documents

Preventive Care Flyer – English & Spanish

Virtual Care Flyer – English & Spanish

Personify Wellness Flyer

Personify Wellness Rewards

Pharmacy Flyer – English & Spanish

Pharmacy Formulary – English & Spanish

Behavioral Health Flyer

Cigna One Guide – English & Spanish

Diabetes and Hypertension Support

Musculosketal Program

Spending Accounts

NEW Group Specified Disease Plan

Group Accident Plan

Employee Discounts

Coverage Period: January 1 to December 31

Group Number: 3345209

Member Services: 877.501.7990

Member Website: https://www.CIGNA.com

How to find a Doctor:

Cigna Health Care Provider Directory

Medical Videos, Guides & Links

2024 Medical Documents

2024 Traditional OAP $1,500 Benefit Summary

2024 Traditional OAP $4,000 Benefit Summary

2024 HDHP-HSA $1,600 Benefit Summary

2024 Traditional OAP $1,500 Plan SBC

2024 Traditional OAP $4,000 Plan SBC

2024 HDHP-HSA $1,600 Plan SBC

2024 Traditional OAP $1,500 Plan SPD

2024 Traditional OAP $4,000 Plan SPD

2024 HDHP-HSA $1,600 Plan SPD

2024 Trad $1500 & HDHP-HSA SPC Cert Rider

2024 Traditional OAP $4,000 SBC Cert Rider

CIGNA One Guide Documents

CIGNA Open Access + Documents

My CIGNA Documents

ATTENTION! myCigna Portal is available to members

Use the QRCode above to learn how to register at myCigna.com. (PDF: myCigna Flyer)

Compliance Links

Cigna – Machine Readable Files

This link leads to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Coverage Period: January 1 to December 31

Group Number: 3345209

Member Services: 877.501.7990

Member Website: https://www.CIGNA.com

Rx Videos, Guides & Links

Pharmacy Documents

Pharmacy Welcome Letter

About Cigna 90 Now Letter

National Preferred July 2023 Prescription Drug List – English & Spanish

Formulary Clinical Update January 2024

Formulary Changes January 2024

Patient Assurance Program – English – Spanish

90-Day Prescription Fills Flyer – English – Spanish

Rx Claim Form with Instructions

Coverage Period: January 1 to December 31

Group Number: 3345209

Member Services: 877.501.7990

Member Website: https://www.CIGNA.com

Wellbeing Videos, Guides & Links

Wellbeing Documents

Diabetes and Hypertension Support

Omada Health Program Access

Omada Health Program Details

Healthy Joints and Pain Relief Support

Hinge Health Flyer – English – Spanish

Veteran Support

Veteran Support and Mindfulness Flyer – English

Pregnancy Support

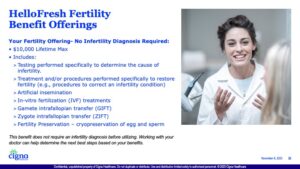

Conception Care Fertility Benefits – English – Spanish

Infertility Benefits – English

Healthy Pregnancy, Healthy Baby Book – English & Spanish

Healthy Pregnancy Rewards – English & Spanish

Breast Pump Order Flyer – English & Spanish

Gender Affirmation Support

My Personal Champion – English & Spanish

There is no charge for MDLive for employees that have the OAP plans.

For those that have the HDHP plan the average per visit charge is between $55 – $125, HOWEVER there is no charge through 12/31/2024!

![]()

![]()

Coverage Period: January 1 to December 31

Schedule Your Appointment: 888.726.3171

Website: MDLive for Cigna

Virtual Care Videos

Use the QRCode above to learn More about your Dental Virtual Care benefit. (Video: Dental Virtual Care)

Dental Virtual Care Documents

Coverage Period: January 1 to December 31

Group Number: 3345209

Member Services: 877.501.7990

Coverage Period: January 1 to December 31

Group Number: 1000278614

Member Services: 800.532.3327

Member Services Fax: 800.726.9982

PIN & Password Assistance: 800.840.7684

Fax Number: 800.726.9982

Website: flores247.com

Mailing Address

Flores & Associates, LLC

PO Box 31397

Charlotte, NC 28231

Coverage Period: January 1 to December 31

Group Number: 3345209

Member Services: 800.244.6224

Website: Cigna.com

ATTENTION!

myCigna Portal is available to members

Use the QRCode above to learn how to register at myCigna.com. (PDF: myCigna Flyer)

How to find a Dentist:

Cigna Health Care Provider Directory

Provider Directory Link

Network = DPPO

Use the QRCode above to learn more about your Cigna Dental PPO Plan. (Video: Cigna DPPO)

Use the QRCode above to learn more about your Dental Preventive Care benefit. (Video: Dental Preventive Care)

Use the QRCode above to learn More about your Dental Virtual Care benefit. (Video: Dental Virtual Care)

Dental Documents

Coverage Period: January 1 to December 31

Group Number: 1029949

Member Services: 866.800.5457

(Mon-Sat, 7:30am-11:00pm EST,

Sun 11:00am-8:00pm EST)

For LASIK: 800.988.4221

Website: EyeMed.com

Vision Documents

FAQs

Additional Documents

Coverage Period: January 1 to December 31

Group Number: 652467

Member Services: 800.421.0344

Claims: 866.868.6737

Unum Portal: Member Portal

Basic Life Documents

(Employer Paid Life)

FAQs

Voluntary Life Documents

2024 Voluntary Life and AD&D Rates

Voluntary Life and AD&D Insurance Plan – English & Spanish

Voluntary Life and AD&D Booklet

Statement of Health – Evidence of Insurability

Portability and Conversion Options

Application for Conversion – Most States | New York | Pennsylvania

Application for Portability – Most States | New York |

Coverage Period: January 1 to December 31

Group Number: 652467

Member Services: 800.421.0344

Claims: 866.868.6737

Unum Portal: Member Portal

Long-Term Documents

Long-Term Buy-up Documents

FAQs

New for 2024: Hospital Insurance and Accident Insurance offered by UNUM.

Coverage Period: January 1 to December 31

Group Number: (Coming Soon)

Member Services: 866.679.3054

8 am – 8 pm EST

Unum Portal: Member Portal

Group Accident Plan Documents

Accident Plan Overview – English & Spanish

Be Well Incentive – English & Spanish

Accident Certificate

Accident Claim Form

Application for Portability – Most States | New York | New Jersey

Group Hospital Plan Documents

Hospital Plan Overview – English & Spanish

Hospital Plan Certificate

Hospital Claim Form

Application for Portability – Most States | New York | New Jersey

Plan Number: 551637

Verification Number: 55163799

Enrollment Services: 888.311.9487

Member Services: 800.584.6001

Rollover Services: 866.865.2660

Participant Website: MyVoya.com

Enrollment Website: VoyaEnroll.com

Retirement Documents

Retirement Enrollment

Member Services: 800.854.1446

Website: UNUM.com/LifeBalance

HelloFresh has partnered with Bright Horizons to support care and education needs for you and your family.

Website: BrightHorizons.com

Phone Number: 877-242-2737

Website Login Information

Employer User Name: hellofresh

Password: hfcares

Member Services: 866.799.2655

Email: [email protected]

You can receive personalized alerts about tests and screenings, check the status of a case in real time, view a snapshot of your benefits package, read healthy tips and articles, hands-free tracking with Apple Health and other fitness devices available to members with Wellness, and Access 24/7 live support to help with healthcare- and insurance-related issues.

Wrap Document

HelloFresh – Protection Against Surprise Billing

Important Notice About Your Prescription Drug Coverage and Medicare

Comprehensive Notice of Privacy Policy and Procedures

Employee Healthcare Plan Notice of Special Enrollment Rights

COBRA General Notice

Notice of Right to Designate Primary Care Provider and of No Obligation for Pre-Authorization for OB/GYN Care

Women’s Health and Cancer Rights Notice

Michelle’s Law Notice

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

Summary Annual Report for Retirement Savings Plan

Summary Annual Report for Health and Wellfare

Health Care Security Ordinance (HCSO)

Medicare Notice

Helpful Terminology

Provider: A clinic, hospital, doctor, lab, health care practitioner, or pharmacy.

Insurer or carrier: The insurance company providing coverage to the policy holder.

Policyholder: The individual or business (“group”) that has entered a contractual relationship with the insurance company.

Insured: The person with the health insurance coverage. For individual health insurance, you may be both the policy holder and the insured.

Premium: The amount of money charged by an insurance company for coverage. The cost of premiums may be determined by several factors, including age, geographic area, number of dependents and tobacco consumption. Policy holders pay these rates annually or in smaller payments over the course of the year, and the amount may change over time. When insurance premiums are not paid, the policy is typically considered void, and companies will not honor claims against it. Self-employed persons may deduct the cost of their individual health insurance premiums from their taxes.

Copayment (Copays): A fixed amount you pay for a covered health care service, usually when you get the service. The amount can vary by the type of covered health care service.

Deductible: The amount you owe for health care services each year before the insurance company begins to pay. For example, if your annual deductible is $1,000, your plan won’t pay anything until you’ve met your $1,000 deductible for covered health care services that are subject to the deductible. The deductible may not apply to all services, such as preventive care services.

Deductibles are useful for keeping the cost of insurance low. The amount varies by plan, with lower deductibles generally associated with higher premiums. They are standard on most types of health coverage.

Coinsurance: Your share of the costs of a covered health care service calculated as a percent (for example, 20 percent) of the allowed amount for the service. You pay coinsurance plus any deductibles you still owe for a covered health service.

Out-of-Pocket Maximum: The most you will be required to pay for your health care during a year, excluding the monthly premium. It protects you from very high medical expenses. After you reach the annual out-of-pocket maximum, your health insurance or plan begins to pay 100 percent of the allowed amount for covered health care services or items for the rest of the year. Copays, deductibles, and coinsurance count towards the out-of-pocket maximum.

Preventive Care: Medical tests and checkups, immunizations, and counseling services used to prevent chronic illness from occurring.

Formulary: A list of prescription drugs covered by the plan. Also called a drug list.

In-Network: A group of doctors, clinics, hospitals, and other healthcare providers that have an agreement with your medical plan provider. You pay a negotiated rate for services when you use in-network providers.

Out-of-Network: Care received from a doctor, hospital or other provider that is not part of the plan agreement. You’ll pay more when you use out-of-network providers since they don’t have a negotiated rate with your plan provider. You may also be billed the difference between what the out-of-network provider charges for services and what the plan provider pays for those services

High Deductible Health Plan (HDHP): This is a type of medical plan that requires the member to reach a deductible prior to having services covered by coinsurance. All expenses paid by the member count toward the deductible and out-of-pocket maximum.

Guaranteed Issue: The amount of coverage that you can receive without having to answer health questions (Evidence of Insurability). The guaranteed issue applies to the voluntary life plan.

Evidence of Insurability: Evidence of Insurability (EOI) is an application with medical questions that you complete in order to be considered for certain types of insurance coverage. Evidence of Insurability applies to the voluntary life and buy-up long-term disability plans.

We welcome your feedback on your HelpSite , please email us at [email protected] | Privacy Policy

© BenefitHelp All Rights Reserved

DISCLAIMER

Every reasonable effort has been made for the information provided to be accurate. It is intended to provide an overview of the coverage’s offered. It is in no way a guarantee or offer of coverage. Each carrier has the ability to underwrite based on its contract. Each carrier’s contract, underwriting, and policies will supersede the information on this page. Please be aware that each carrier may have exclusions or limitations and you must consult your summary plan description and/or policies for details.