My Employee Benefits

Our employees are our greatest resource and we take pride in being able to offer comprehensive and affordable benefits for all of our employees and their families.

To register, FIRST TIME ONLY

Use Company Identifier = Tier1Fire

RETURNING Users Login Above

How to use the System Video

Read about your benefits

12/5 Meeting replay click above

Click on one of the tabs to learn more about that benefit.

Plan starting 1-1-25

![]()

First Primary Care Website

Member / Provider Support: (832) 737-8622

About the FPC Program

Coverage Period:

JAN 1 – DEC 31

Group Number: FPCTF

Medical Claims Administrator For Doctor, Medical, and Rx Support:

Contact Yuzu

Phone: (203) 208-9898

E-mail: [email protected]

Website: www.yuzu.health

Member portal: yuzu.health/signin

Rx Perscription Administrator

First, check Magic Pill using the Magic Pill App

Drexi is the Pharmacy Benefit Manager

www.drexi.com

Member portal: drexi.com/signin

Phone (844) 728-3479 Customer Service

Phone (877) 668-5461 Rx Advocacy

Rx Bin: 018448

PCN: 66202303

Find a Cigna provider: Click here

The new DPC (Direct Primary Care) Plan is through First Primary Care. We are the quarterback to guide you through the healthcare maze.

Before the start of your Plan:

If you have upcoming appointments, have a relationship with a PCP or are on prescription medications and want help understanding how you will continue accessing care, please answer the questions in this document and someone from the FPC team will reach out when they have an answer. Use this link

On or after the effective date of your Plan.

New Member Welcome Kit

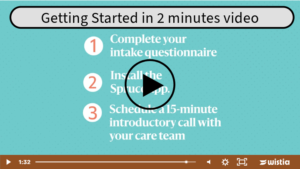

Getting Started One Page Three Easy Steps

(you will receive an e-mail on the 1st day your plan becomes effective)

Medical

SBC – Summary of Benefits & Coverage

Simple One Page Summary – English

About the PFC Program

Labs Included with DPC Membership

Video about the plan – coming soon

Prescription Drugs (Rx)

Magic Plill Program and Drug List – 2024

Get the Magic Pill Phone app for Apple IOS

Additional Information

Medical 2025 Plan Summary

Plan Year: Jan. 1 through Dec. 31 (Enrolled before 8-1)

If enrolled after 8-1 See Ameriflex information below.

Customer Service: 1-866-346-5800

Health Equity Website

Click Here to Log Into Your Account

Health Savings Account Information

HSA Eligible Expenses

Helpful Documents

Flexible Spending Account

Premium Only Plan

FSA Overview

FSA Eligible Expenses

FSA Claim Form

HSA/FSA Options

Health Savings Account (Only Eligible with the HDHP Medical Plan)

Employees may set aside, via payroll on a pre-tax basis, funds to pay the health insurance deductible and

qualified medical expenses, including dental and vision care. An HSA account is only valid with the High

Deductible Medical Plan.

Healthcare: Up to $3,850 for an individual and $7,750 for a family can be set aside to pay for certain

eligible expenses. Individuals 55 and older can save an additional $1,000.

Flexible Savings Account (Only Eligible with the CoPay Medical Plan)

Employees may set aside, via payroll on a pre-tax basis, funds to pay the health insurance deductible and

qualified medical expenses, including dental and vision care.

Healthcare: Up to $3,050 can be set aside to pay for certain eligible expenses. The maximum carryover

for 2022 is $570.

Dependent Care: Up to $5,000 (Individual or Married Filing Jointly) or $2,500 (Married Filing Separately)

can be set aside to pay for certain childcare and dependent care expenses.

Virtual Care Documents

Virtual Care Documents

Plan Year: Jan. 1 through Dec. 31

Group Number: 1154542

Customer Service: 1-800-247-4695

Dental & vision claims

Principal

P.O. Box 10357

Des Moines, IA 50306-0357

Phone: 800-247-4695

Fax: 866-301-1502

Submit claims:

CSD [email protected]

General claims questions:

[email protected]

Helpful Documents

Plan Year: Jan. 1 through Dec. 31

Group Number: 1154542

Customer Service: 1-800-247-4695

Dental & vision claims

Principal

P.O. Box 10357

Des Moines, IA 50306-0357

Phone: 800-247-4695

Fax: 866-301-1502

Submit claims:

CSD [email protected]

General claims questions:

[email protected]

Plan starting 1-1-25

![]()

Group Number: BCN : E6239990

Customer Service: 1-800-325-4368

TTY/TDD: 1-803-798-4040

Helpful Documents

Critical Illness w/Cancer TN Product Info

Summary Page from Benefits Guide

Critical Illness – RATES

Group Critical Illness Certificate Policy

Facts of Critical Illness

Wellness Screening Claim Form

Critical Illness Claim Form

Universal Claim Form

Request for Service Form

Service Guide

Plan starting 1-1-25

![]()

Group Number: BCN : E6239990

Customer Service: 1-800-325-4368

TTY/TDD: 1-803-798-4040

Helpful Documents

Accident Preferred Product Information

Accident Rates – See Benefit Guide

Accidental Death & Dismemberment benefit included

Group Accident Certificate Policy

Change of Beneficiary FAQ

Change of Beneficiary Form

Plan starting 1-1-25

![]()

Group Number: BCN : E6239990

Customer Service: 1-800-325-4368

TTY/TDD: 1-803-798-4040

Plan starting 1-1-25

![]()

Group Number: BCN : E6239990

Customer Service: 1-800-325-4368

TTY/TDD: 1-803-798-4040

Helpful Documents

What’s the difference between term life and whole life?

Group Voluntary Term Life Info – see Benefit Guide

Group Term Life RATES

Group Term Life Certificate Policy

Whole Life Product Info

Chronic Care Accelerated Benefit

Juvenile Chile Whole Life Info

Whole Life RATES

Whole Life Sample Policy

Change of Beneficiary FAQ

Change of Beneficiary Form

Universal Claim Form

Request for Service Form

Service Guide

Voya 401k – Pretax and Roth Plans

Employees may elect to enroll in a 401k plan through Voya Financial. Employees are eligible after 90 days of employment. Employees must be over 21 to enroll. We offer two ways to invest. Pre-tax 401k: Your contributions are not taxed at the time of investment; taxes will be paid at the time of withdrawals. The company matches 1:1 percent up to employee contribution of 3%; then the company matches 0.5:1 percent for employee contribution of 4-5%. The company matches 4% of employee contribution of above 5%. Roth 401k: Your contributions are invested as after-tax investments. No taxes will be paid at the time of withdrawal. The company matches 1:1 percent up to employee contribution of 3%; then the company matches 0.5:1 percent for employee contribution of 4-5%. The company matches 4% of employee contribution of above 5%. Example: Employee contribution (EE) and Employer contribution (ER); EE:ER = 1:1; 2:2; 3:3; 4:3.5; 5:4; 6:4; 7:4… and so on.

Please contact HR with any additional questions about how to enroll electronically. When eligible, HR will send you via email how to enroll in Tier 1 Fire Protection’s 401k plan.

Plan Number: 551637

Verification Number: 55163799

Enrollment Services: 888.311.9487

Member Services: 800.584.6001

Rollover Services: 866.865.2660

Participant Website: MyVoya.com

Enrollment Website: VoyaEnroll.com

Additional Information Coming Soon

Helpful Documents

|

Important legal information about the Health & Welfare benefits available through Tier 1 Fire Protection LLC is posted at: Access Code: 066T3698 To request a free paper copy of the information included on the website, contact the HR department. |

Documents

2024 Safe Harbor Notice

Health Insurance Marketplace Notice

COBRA Notice

HIPAA Privacy Policy

Surprise Billing Notice

CHIP Notice

Wellness Plan Notice

Notice of Special Enrollment Rights

Rx and Medicare Notice

GINA Notice

OBGYN Notice

USERRA Notice

Michelles Law Notice

Womens Health and Cancer Rights Notice

Newborns and Mothers Health Protection Disclosure

4 Benefit Needs Planning Worksheet – This worksheet guides your benefits choices and how they fulfill your financial needs. TIP- Watch the 4 Needs video

Helpful Terminology

Provider: A clinic, hospital, doctor, lab, health care practitioner, or pharmacy.

Insurer or carrier: The insurance company providing coverage to the policy holder.

Policy holder: The individual or business (“group”) that has entered a contractual relationship with the insurance company.

Insured: The person with the health insurance coverage. For individual health insurance, you may be both the policy holder and the insured.

Premium: The amount of money charged by an insurance company for coverage. The cost of premiums may be determined by several factors, including age, geographic area, number of dependents and tobacco consumption. Policy holders pay these rates annually or in smaller payments over the course of the year, and the amount may change over time. When insurance premiums are not paid, the policy is typically considered void, and companies will not honor claims against it. Self-employed persons may deduct the cost of their individual health insurance premiums from their taxes.

Copayment (Copays): A fixed amount you pay for a covered health care service, usually when you get the service. The amount can vary by the type of covered health care service.

Deductible: The amount you owe for health care services each year before the insurance company begins to pay. For example, if your annual deductible is $1,000, your plan won’t pay anything until you’ve met your $1,000 deductible for covered health care services that are subject to the deductible. The deductible may not apply to all services, such as preventive care services.

Deductibles are useful for keeping the cost of insurance low. The amount varies by plan, with lower deductibles generally associated with higher premiums. They are standard on most types of health coverage.

Coinsurance: Your share of the costs of a covered health care service calculated as a percent (for example, 20 percent) of the allowed amount for the service. You pay coinsurance plus any deductibles you still owe for a covered health service.

Out-of-Pocket Maximum: The most you will be required to pay for your health care during a year, excluding the monthly premium. It protects you from very high medical expenses. After you reach the annual out-of-pocket maximum, your health insurance or plan begins to pay 100 percent of the allowed amount for covered health care services or items for the rest of the year. Copays, deductibles, and coinsurance count towards the out-of-pocket maximum.

Preventive Care: Medical tests and checkups, immunizations, and counseling services used to prevent chronic illness from occurring.

We welcome your feedback on your HelpSite , please email us at [email protected] | Privacy Policy

[lmt-post-modified-info]

✟ © BenefitHelp All Rights Reserved

DISCLAIMER

Every reasonable effort has been made for the information provided to be accurate. It is intended to provide an overview of the coverage’s offered. It is in no way a guarantee or offer of coverage. Each carrier has the ability to underwrite based on its contract. Each carrier’s contract, underwriting, and policies will supersede the information on this page. Please be aware that each carrier may have exclusions or limitations and you must consult your summary plan description and/or policies for details.